Curious to know how to scale your Facebook Ads over $1,000/day? Get our experts' recommendations for free! All our clients went through this step!

Our September 2021 Facebook Ads Tests

To be the first to receive our test results, subscribe to our iOS 14 Squad Newsletter! Click here to subscribe for free and begin taking advantage of our expert tips.

Lookalike CRM vs. Lookalike Pixel Event

Here is our latest test as of September 6th.

One of the consequences of iOS 14 working a number on Facebook has been the loss of data.

This has not only impacted Conversion Campaigns (outside of Facebook), but another element as well in a much more insidious way…

Something created with the help of this lost data, the backbone of Facebook’s platform: Lookalike audiences.

In May 2021, we noticed several changes to the platform, and the loss in performance from Lookalike audiences was one of the most integral changes we noticed. It makes sense in the end. With less data, the data used to create Lookalike audiences just won’t be as good (and neither will the audiences).

For this very reason, the iOS 14 Squad recently tested out Broad audiences and ended on the following result.

That being said, should you completely stop using Lookalike audiences? Can importing more data over a 180-day period from a third-party source help?

What if you create Lookalikes directly from data imported from your clients’ CRMs?

For this week’s test, we did exactly that! We tested a standard Lookalike audience (ex: Purchase - 180 days) against data (manually) imported from our clients’ CRMs.

Here are the results of our tests for a number of clients as of September 6th.

TEST #1 - E-COM CLIENT - 8 DAY TEST.

Objective: Conversion / Purchase

We tested a Lookalike audience from the client's database versus one from Facebook. The campaign also included an Interest-based audience.

Results:

CRM LK:

- Budget $280.45

- ROAS: 1.91

- CAC: $21.57

Event LK:

- Budget: 225,45$

- ROAS: 2.82

- CAC: $20.50

Conclusion: It's obvious that the Event Lookalike audience performed better than our client's CRM import. There is an almost 1-point difference in ROAS, yet the new audience almost generated a ROAS of 2. It would be interesting to run this experiment again or use both audiences together.

---------------------------------------------------------------------

TEST #2 - LEAD GEN CLIENT - 31 DAY TEST.

Objective: Conversion / Lead

Client #2 sells custom engagement rings. Our job is to generate leads for the client’s acquisition funnel to get prospects to make a purchase months later. We used 2 data sources in 2 separate campaigns:

- Pixel Conversion Value [This source is essentially leads with an assigned monetary value]

- CRM leads with an assigned value

Results:

CRM:

- Budget = $1,720

- Results = 95 leads

- CPL = $18.1

Pixel:

- Budget = $3,836

- Results = 269 leads

- CPL: $14,26

Conclusion: We do not recommend this test. Data from the Facebook Pixel performed significantly better.

---------------------------------------------------------------------

TEST #3 - INFOPRENEUR CLIENT - 15 DAY TEST.

Objective: Conversion / Lead

Client #3 sells training programs. Our job is to generate leads for a free webinar that includes the introductory chapter of a paid training program. We usually use the “Leads - 180 days” data from the client’s Pixel, but for this test, we also used "Leads" data directly from the client's email database.

Results :

CRM:

- Budget = 893 euros

- Results= 37 leads

- CPL: 24.14 euros

Pixel:

- Budget = 5,877.31 euros

- Results= 259 leads

- CPL: 22.69 euros

Conclusion: The test is ambiguous. Despite the considerable difference in budgets, we see that there is not a significant advantage (if any) in using a LK + CRM combo rather than using a LK directly from the Pixel. Our hypothesis is that in a few months, using CRM data will be much more interesting simply because our client will have gathered more contacts. However, Facebook's algorithm will not generate a LK as powerful as our previous LKs.

---------------------------------------------------------------------

TEST #4 - E-COM CLIENT- 3 DAY TEST.

Objective: Conversion / Purchase

For a campaign with many temporary audiences (we were testing quite a bit at the time), we ran a 3% 180-days Lookalike Audience versus a 3% CRM Buyers Lookalike audience. We set a high number of exclusions, so we were working with 100% cold audiences.

Results:

CRM:

- Budget: $713

- Purchases: 12

- CAC: $59.43

Pixel:

- Budget: $3,000

- Purchases: 48

- CAC: $62.67

Conclusion: Although the CRM has 25,000 more prospects in its audience, Facebook spent significantly more on our Facebook Event LK! For this reason, we can't say whether the CAC would be the same for the CRM LK audience if it had received the same budget. We would have to run this test again.

---------------------------------------------------------------------

It's clear that this test's results are not in the green: Event Lookalikes usually receive all of the budget or perform better than CRM LKs. We tested different databases from these client's CRMs (some included a few thousand prospects and some tens of thousands), and none of them seemed to make that much of a difference.

Facebook’s Event Lookalike audiences still appear to have some fuel in them before they potentially get replaced by new data sources!

However...

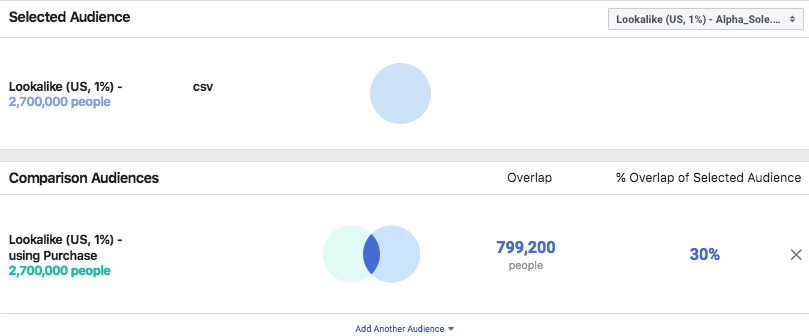

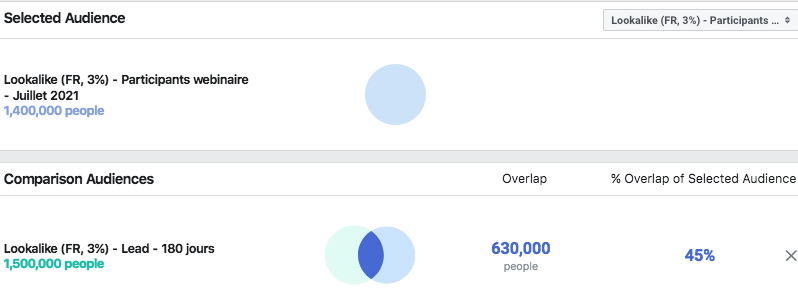

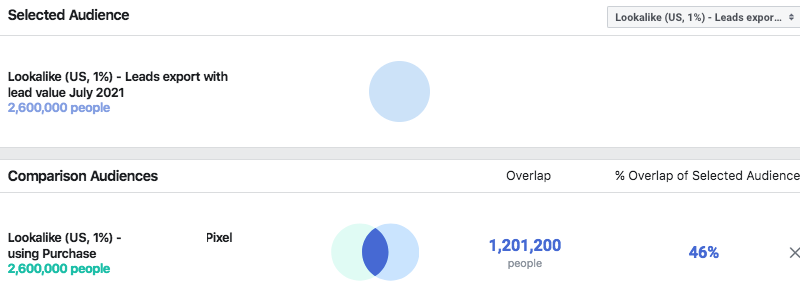

Let's take a look at the overlap between CRM Lookalikes and Event Lookalikes for 3 of our tests.

Two LK audiences (same %) have an overlap between 30 and 46%, which leads us to the following hypothesis:

Could it be that your "super-shopper" audience can be found in the dark blue portion of the diagrams above?

It's difficult to test as it is impossible to use Narrow Audiences for custom audiences (you can only do so for Interest-based audiences). So, you're better off testing your audiences together so that at least your ad set will reach a larger audience.

Facebook : Lead Ads vs. Landing page

On July 9th, 2021, we sent you our first-ever iOS 14 Squad test. In that test, we touched on a number of potential Lead Ad strategies.

Since then, we’ve invested no less than $80,000 and performed tests over 650 days in order to provide you with the most compelling Facebook advertising insights.

All of which our loyal readers have been very keen to discover every single week!

And for that, we sincerely thank you.

For this week’s test (September 13, 2021), we’re revisiting our very first test on Lead Ads, but providing far more context.

Recently, one of our Media Buyers tried using Test #1's recommended Lead Ad strategies for one of our trickier client accounts, and managed to generate outstanding results.

But, let’s talk about the client first.

The client in question is a Canadian Lead Gen. They put individuals in contact with real estate professionals to get their properties evaluated (and then later sell their properties).

Historically, we redirected prospects to a landing page that always worked well, and in the worst case, generated a CPL of $10 back in August 2020.

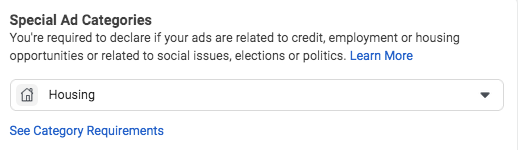

Since then, as you surely know, the platform has changed and evolved greatly. But iOS 14 wasn’t the only challenge we faced here. Facebook's algorithm has become much stricter and has begun requiring that many accounts use Special Ad categories.

As soon as your ad touches on Banking, Employment, or Housing, Facebook imposes severe constraints.

This involves very broad targeting (it is impossible to choose an age or gender segment) and many interest-based criteria disappear (in addition to not being able to exclude audiences).

As you can see, the game’s getting harder for Lead Gen advertisers.

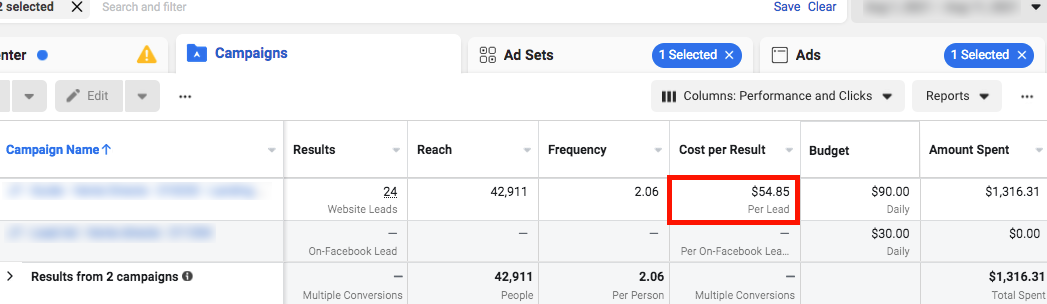

So much so that our CPL, just before our test, hit a crazy amount despite the fact that we optimized our creatives and audiences.

Regardless, our media buyer ran the test, taking the best ads from the current campaign (before the price increase) and copy/pasted bits from the landing page into his Lead Ad campaign’s form.

Here are the results of his campaign.

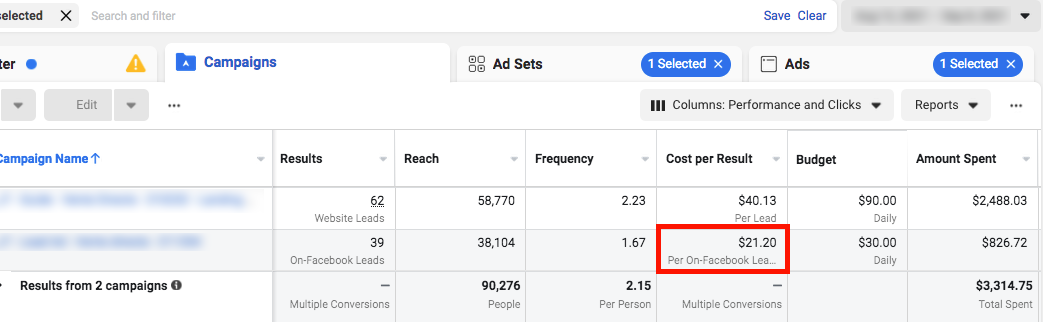

As you can see in the image above, the campaign cut the CPL in half and we are 100% confident that we can scale the campaign.

We used only one audience (no interest-based criteria) and 7-day click attribution (For the conversion campaign, we used both 7-day click and 1-day view).

Now more than ever, we strongly advise you to always run two Lead Gen campaigns. One Lead Conversion that redirects to a landing page and one Lead Ad (directly on Facebook). It’s so easy to set up that it would be silly not to test it!

BROAD Audience vs. Lookalike audience

On September 14th, we received a very important email from our Account Manager Partner at Facebook. She informed us of a major change that will be taking place on the platform starting September 21st and applied, day after day, on all advertising accounts.

If you’re an advertiser that has Conversion/App Install campaigns optimized for events, value, or in-app events: this change concerns you.

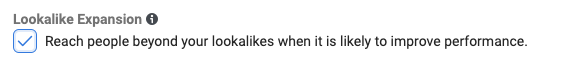

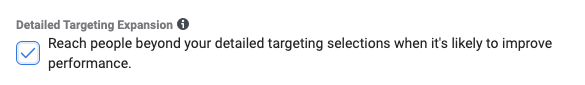

From this point on, Targeting Expansion will automatically be applied to your Interest-based or Lookalike audiences (events or external database) for all of your campaigns.

This means that your audiences will be MUCH bigger than before, and the reason is rather simple.

Facebook has discovered that using Targeting Expansion will cause your incremental CAC to decrease by 10.1, 17.3, or 37%, depending on the type of audience (Interest-based audiences being in first place).

The downside is that your audiences will simply resemble BROAD audiences (in other words, no targeting = huge volume).

On July 16, 2021, we tested out the possibility of using BROAD audiences for your campaigns. Now that large audiences will become the norm, how effective are they, really?

Let's take a look back at one of these tests.

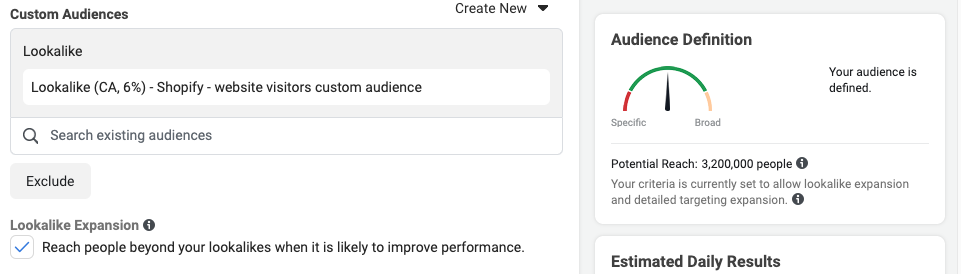

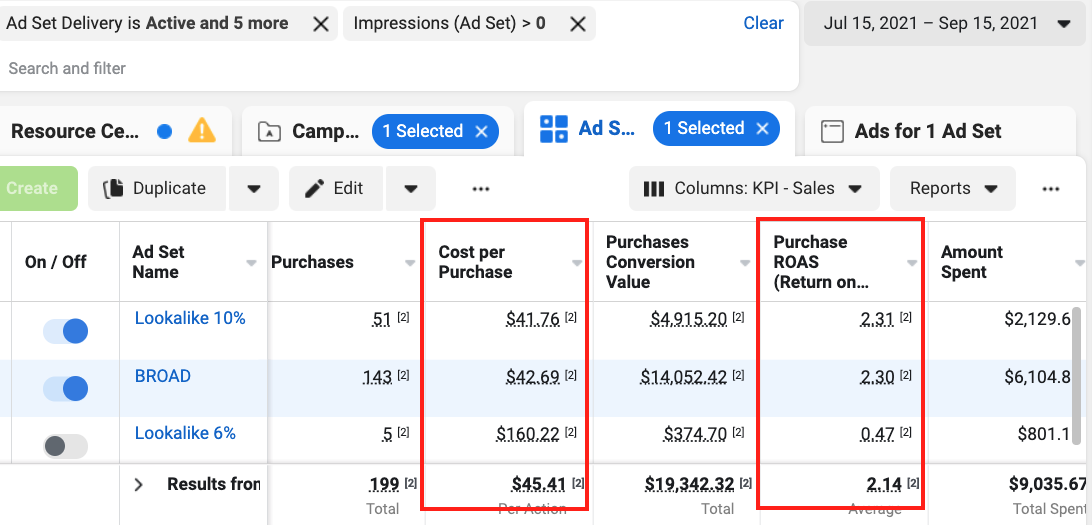

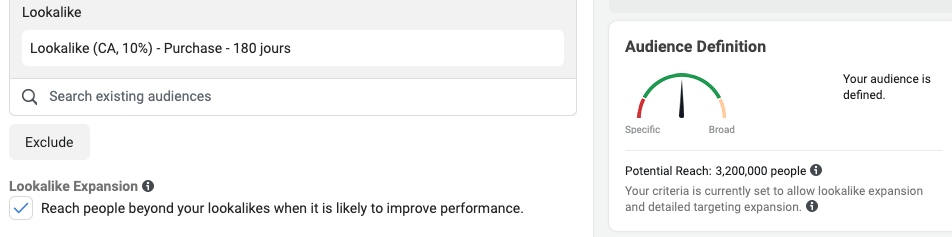

For a Canadian e-commerce company that sells shoes, we tested a BROAD audience against a Lookalike audience (6%) that had Targeting Expansion enabled.

Here are the results for June/July.

——————————

BROAD

- Amount Spent : $6,823

- ROAS : 3.07

- Purchases : 182

- CAC : $37

LOOKALIKE 6% (Targeting Expansion)

- Amount Spent : $3,497

- ROAS : 1,73

- Purchases : 76

- CAC : $46

Without question, the BROAD audience totally outperformed our LK6%.

——————————

What does the situation look like today?

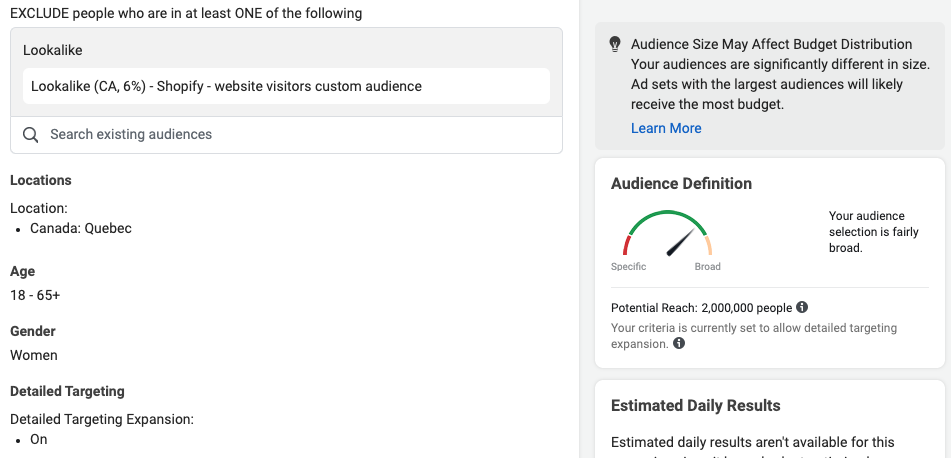

Here are the numbers.

As you can see, we replaced our LK6% audience by a LK10% simply because the initial audience was no longer as competitive.

But, there’s also another interesting stat to consider. The LK10% audience is generating a better CAC than the (now retired) LK6% (from $46 to $41). Even more, this audience's ROAS has exceeded that of the BROAD audience, although the LK6% and LK10% have exactly the same volume.

However, the majority of the budget is still largely being spent on the BROAD audience. It’s possible that if the LK10% audience received the same amount of budget, the ROAS would logically decrease.

We can draw 2 conclusions.

1/ You should test out BROAD audiences.

We’ve been using the BROAD audience for this campaign for 3 months now, and it continues to hold its own against Facebook’s Lookalikes.

2/ It is likely that Targeting Expansion for Lookalike audiences has improved, as reported by Facebook. This may be why they’ve decided to make it mandatory for these types of campaigns.

In any case, the era of small acquisition audiences is over, and the time has come for audiences comprised of several millions of people. And, as we've often said, when Facebook launches a new tool, it’s better to adopt it and master it as quickly as possible!

Facebook Video view funnel

It’s Monday, September 27th, Black Friday is on the horizon, and we’ve already covered our top 4 strategic pillars. These pillars are:

- Begin your Black Friday marketing well before Black Friday (almost 1 week before!)

- Use a single conversion campaign to centralize your data and learnings

- Base your offers on easy to understand discounts (25-60% off)

- Avoid relying solely on the Facebook Pixel for data.

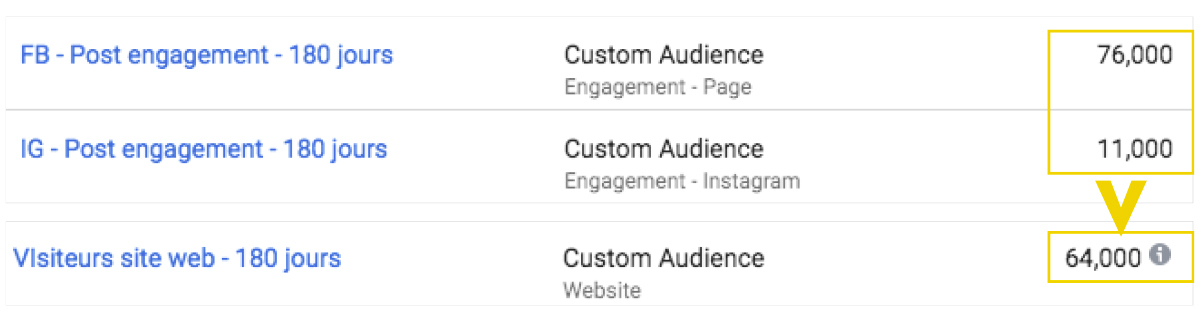

Now, let's take a look an e-commerce’s audiences for this week’s test.

As you can see, the volume of engaged prospects from their Facebook and Instagram pages combined (only over 180 days) far exceeds their website visitors. This gives us far more people to retarget than identified by the Facebook pixel.

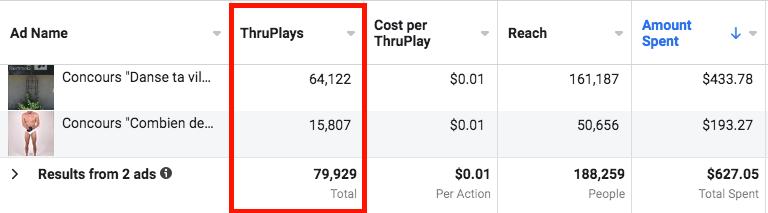

So, for this test, we sought to convert only these audiences by using a video sales funnel. The integration was very simple: we set up a Video Views campaign with a contest that required only a comment as entry.

As you can probably already guess, we managed to generate a massive volume of interactions, but it's the video views we were really interested in!

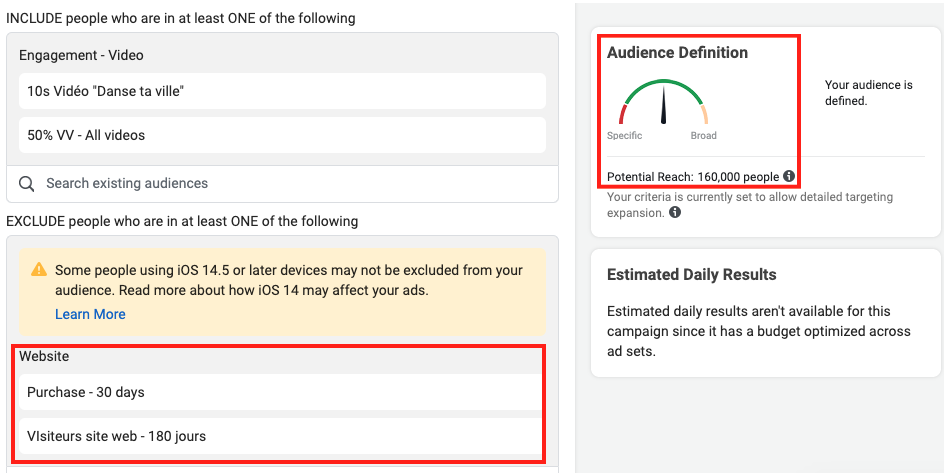

Once we gathered an adequate and substantial number of prospects from our video views, it was time to retarget these prospects in a Conversion/Purchase campaign.

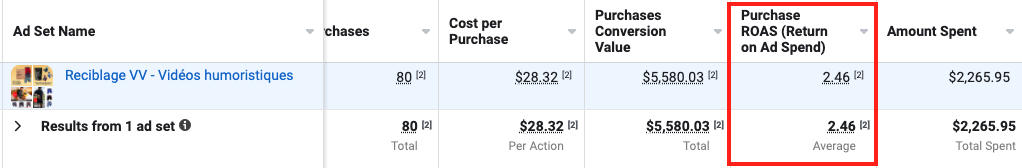

Take note that here we excluded, without remorse, all visitors within a period of 180 days! We ran a campaign featuring our usual promotional offers and targeted the video views audience. Here are the results:

With a simple Video Views campaign and Conversion campaign, we transformed our audience from viewers to customers! If we take our budget for the Video Views campaign into consideration, we hit a ROAS of nearly 2. Which is exceptional considering we converted prospects that never visited our client's site!

With about 1 month’s worth of data, you’ll be able to acquire a substantial audience. And if 1 month isn’t enough, add viewers from your previous video campaigns.

Plus, don't forget that Video Views campaigns will be one of our 4 strategic pillars for Black Friday (and for warming up our audiences), as it allows us to avoid relying too much on the Facebook pixel!

If you know someone else who’d be interested in our newsletter, feel free to share this with them or direct them to our subscription page here.